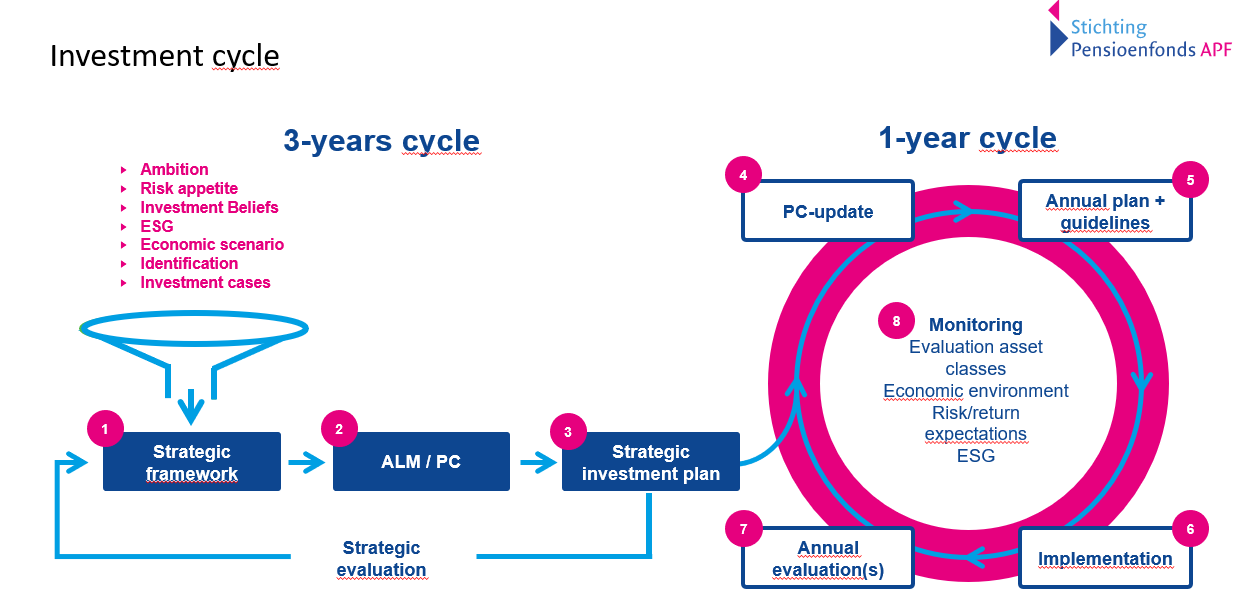

This is how we invest, step by step

The strategic framework is the starting point for the investment cycle, which is as follows:

Three-year cycle

The strategic framework is the input for the ALM study that we perform periodically. This study is based on a long-term baseline scenario for economic developments, but we also calculate various shock scenarios. One such shock scenario, for example, is a confidence shock where consumers, producers and investors have little or no trust in the government's policy to combat climate change.

We lay down the strategic investment policy and the policy is reviewed each year by the Board to see if the ambition is still feasible in light of the sustainability risks and economic situation. Also each year, the impact we want to have in the field of sustainability is assessed and, if necessary, refined. Depending on the asset class, concrete impact objectives are included in the mandate of the asset manager.

Annual cycle

An annual investment plan is drawn up every year, containing the investment objectives and actions in the portfolio for the coming year. The operational asset managers and investment institutions give substance to the investments, taking into account the objectives and restrictions of the portfolio. The asset managers apply their own investment process and account for the returns achieved and how they limit the risks in the portfolio, including environmental, social and governance risks. The board monitors the results and annually assesses whether adjustments are necessary and possible.