Funding ratio March 2022

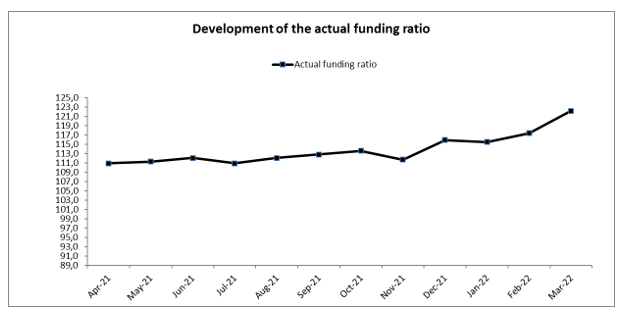

In the past month the (actual) funding ratio rose from 117.4% to 122.2%. As the return on investments was negative, the invested capital decreased. As of the end of March, the interest rate has increased which resulted in a decrease in provisions that was sufficient to compensate for the negative returns. Provisions refer to the money that the pension fund must reserve to be able to pay all future pensions.

The actual funding ratio as of March, 2022 is 122.2%

The actual funding ratio is the funding ratio measured at the end of the month. This funding ratio immediately shows the consequences of financial developments and can therefore fluctuate significantly, as shown in the chart below.

Development of the actual funding ratio over the past 12 months

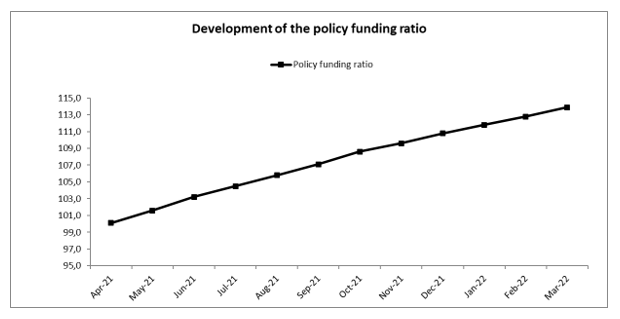

The policy funding ratio as of March, 2022 is 113.9%

The policy funding ratio is the average of the last 12 actual funding ratios. The policy funding ratio is the most important funding ratio. Policy decisions on indexation and curtailment of your pension are based on this funding ratio. By using an average, this funding ratio shows less fluctuations than the actual funding ratio.

Development of the policy funding ratio over the past 12 months