Defined contribution scheme

As a participant in the pension scheme administered by APF Pension Fund, you will accrue a pension on the salary you earn per year. If your fixed annual salary is more than € 84,857 gross per year (2025) (AkzoNobel) or € 86,447 gross per year (2025) (Nouryon, Nobian en Salt Specialties), the income above these amounts, up to a maximum of € 137,800 gross per year (2025) will be subject to a defined contribution scheme (DC scheme).

The employer will make a contribution commitment under the DC scheme and pays your contribution into APF Pension Fund. The DC scheme entails that the ultimate value of the pension achieved from the contributions invested is not known in advance. So you run a risk on the investments, but you also benefit when returns are achieved.

The contribution will be invested until your retirement date. When you retire, you can opt for an additional pension with APF Pension Fund or for a variable pension outside APF Pension Fund.

If you choose an additional pension with APF Pension Fund, your capital will be used to purchase a pension within APF Pension Fund. The amount of your additional pension depends on the investment results and the monthly purchase rates that we use at that time. These purchase rates are calculated on a monthly basis. The appendix to the pension regulations contains the rates for January. The current purchase rates can be found at the bottom of this page.

When you start participating in the DC scheme your contribution is invested in principle in ‘Lifecycle Neutral 2021’. There are 2 other investment portfolios with a different risk profile: ‘Life cycle Offensive 2021’ and ‘Lifecycle Defensive 2021’. On My pension you can determine your risk profile yourself by using the investment balance. Subsequently, your contribution will be invested in the corresponding lifecycle.

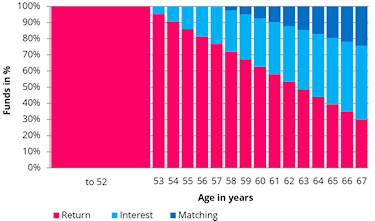

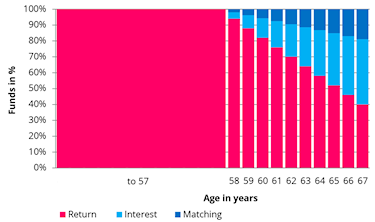

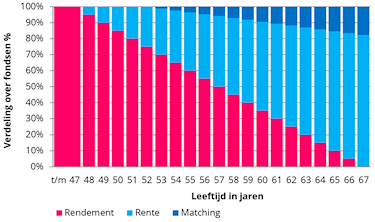

In each lifecycle we use a combination of 3 modules (Matching, Interest and Returns). In all modules we start with shares- and interest risks. As the retirement date approaches, these risks are reduced. In the lifecycles we use a different balance between achieving sufficient investment returns and limiting volatility (the degree to which the pensions to be purchased are volatile) in the years before pension commencement.

Explanation of the modules

- Module Matching

This portfolio is aimed at matching interest movements on the capital market by means of interest rate contracts and liquidities. - Module Interest rate

These are investments in fixed income securities (bonds and mortgages). Used to decrease the risk as the retirement date approaches. - Module Return

Mainly investments in shares. The objective is to achieve returns for a sufficiently high pension benefit.

In this lifecycle your paid contribution is fully invested in shares until the age of 53. As you get older the investment percentage in shares is reduced. We then invest to a greater extent in bonds in particular. We also limit the so-called interest risk as of the age of 58, as you can see in the figure.

In this lifecycle your paid contribution is fully invested in shares until the age of 58. As you get older the investment percentage in shares is reduced. We then invest to a greater extent in bonds in particular. We also limit the so-called interest risk as of the age of 58, as you can see in the figure.

In this lifecycle your paid contribution is fully invested in shares until the age of 48. As you get older the investment percentage in shares is reduced. We then invest to a greater extent in bonds in particular. We also limit the so-called interest risk as of the age of 53, as you can see in the figure.

Watch the video on options for pension benefit payments

In the DC scheme, you have a choice between an additional or a variable pension benefit.

APF Pension Fund has made a video about this.